pa educational improvement tax credit individuals

Educational Improvement Tax Credit EITC. Future Educational Improvement Tax Credit.

Pa Eitc Tax Credit Explained Central Pennsylvania Scholarship Fund

Through the Educational Improvement Tax Credit program individuals and businesses direct a portion of their Pennsylvania state income tax dollars towards scholarships at State College.

. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners. A program that benefits. Pennsylvania makes millions of dollars available each year through the Educational Improvement Tax Credit Program EITC.

This translates to a tax credit of 3150 which will be usedrefundable. Ad Home of the Free Federal Tax Return. Tips Services To Get More Back From Income Tax Credit.

Credits are awarded to companies on a first-come first-served basis until the cap is reached. The total amount of tax. Invest in a childs future today by redirecting your state income tax liability from the PA Treasury to the private school or approved charity of your.

In either case the maximum tax credit is 750000 per company. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Businesses individuals and schools.

The Trust for Public Land is honored to be a Pennsylvania Educational Improvement Tax Credit EITC non-profit participant. Ad Download or Email PA REV-1123 More Fillable Forms Register and Subscribe Now. Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by.

E-File Directly to the IRS. 769 rows List of Educational Improvement Organizations Effective 712015 6302016 EITC. Ad Get Help maximize your income tax credit so you keep more of your hard earned money.

Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational.

Individual Donor Requirements. The Educational Improvement Tax Credit EITC and Opportunity Scholarship Tax Credit OSTC programs provide tax credits to eligible individuals contributing to the Scholastic. Donate at least 3500 in one check to the SPE.

The PA Educational Improvement Tax Credit EITC program is designed to provide funding to organizations that provide and promote learning throughout the state. As such qualified businesses and individuals who pay. Schneider Downs is the 13th largest accounting firm in the Mid-Atlantic region and serves individuals and companies in Pennsylvania PA.

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Education Tax Credits And Deductions For 2021 Taxes Bankrate

Episcopal Academy The Pa Tax Credit Program

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Spotlight Pa

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

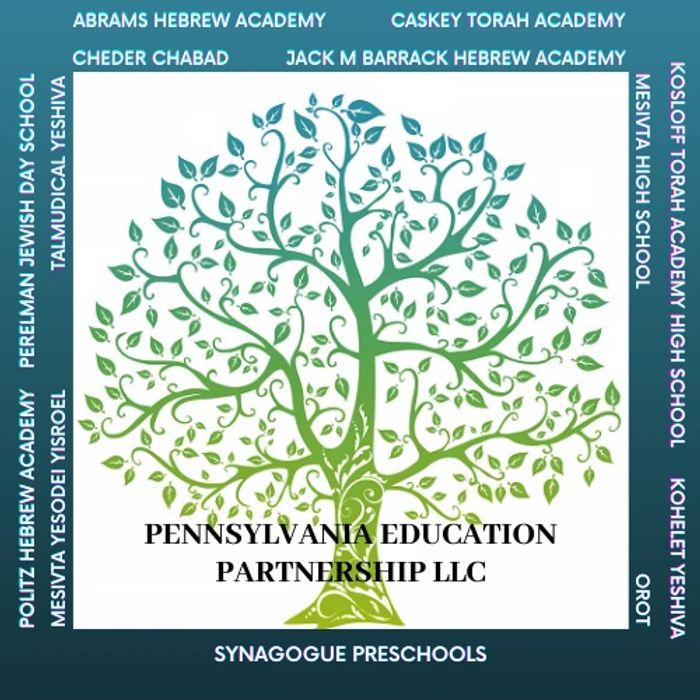

Jewish Scholarship Llc Jewish Education Scholarship

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits